Eic 2025 Limits And

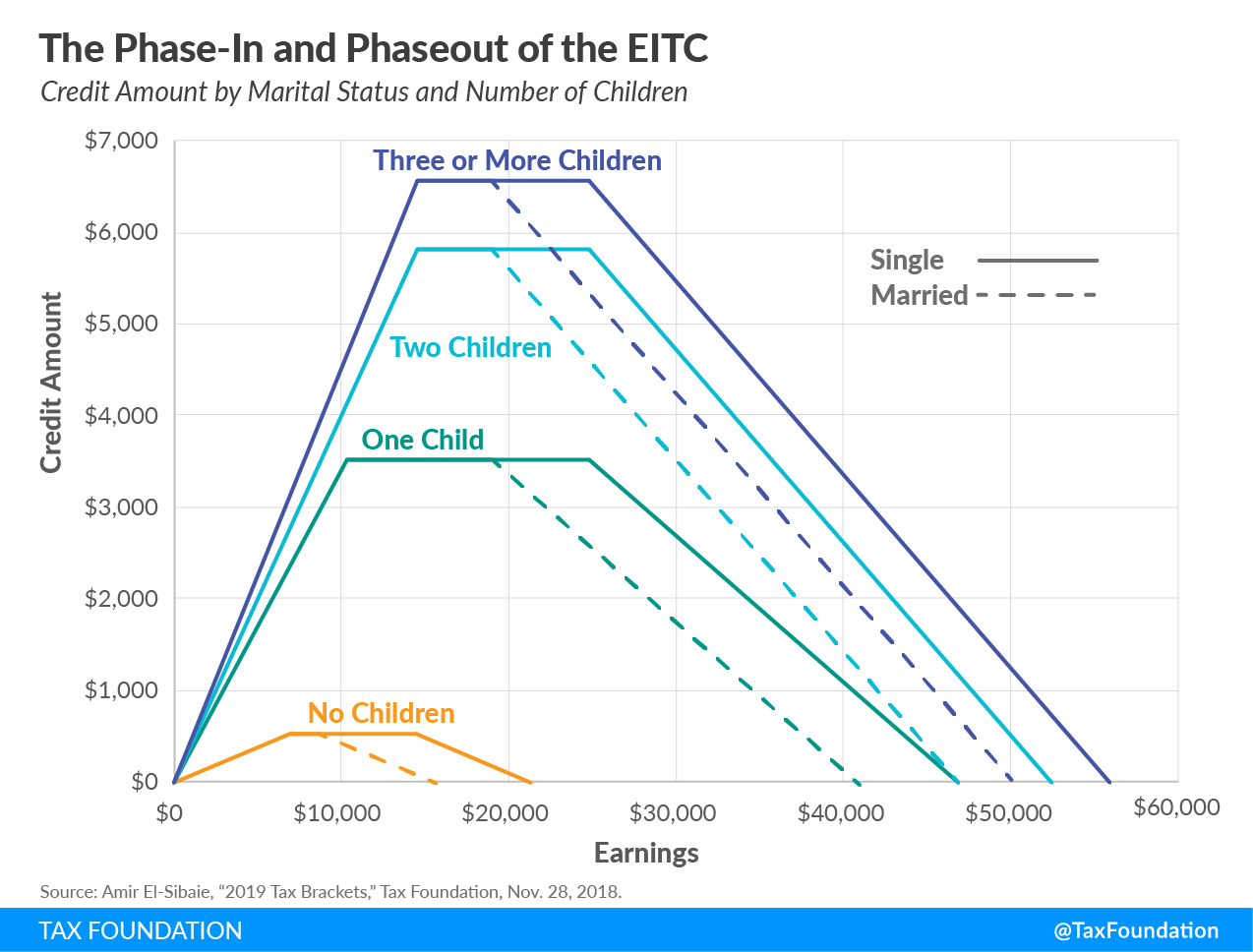

Eic 2025 Limits And. If you earned less than $66,819 (if married filing jointly) or $59,899 (if filing as single, qualifying surviving spouse or head of household) in tax year 2025, you may qualify. Key eligibility requirements for the earned income tax credit (eitc) in 2025 (tax year 2025):

The eic table can calculate earned income credit (eic) and other related credits. Following are the conditions for claiming eitc on 2025 (filing april 2025) & 2025 (filing april 2025 )tax returns:

Eic Limits 2025 Over 65 Zea Lillis, [updated with 2025 irs adjustments] below are the latest earned income tax credit (eitc) tables and income qualification thresholds adjusted for recent tax years and new legislation.

Eic Limits 2025 Single Zara Engracia, The earned income credit (eic) is a refundable tax credit available to working individuals with low to moderate incomes.

Earned Limits 2025 Moina Terrijo, The earned income credit (eic) is a refundable tax credit available to working individuals with low to moderate incomes.

Eic Table 2025 Limits Ruthe Clarissa, Following are the conditions for claiming eitc on 2025 (filing april 2025) & 2025 (filing april 2025 )tax returns:

Eitc Limits 2025 Aubine Gaylene, The earned income limits are adjusted annually to factor in inflation.

Eic Limits 2025 Glad Willie, The eic table can calculate earned income credit (eic) and other related credits.

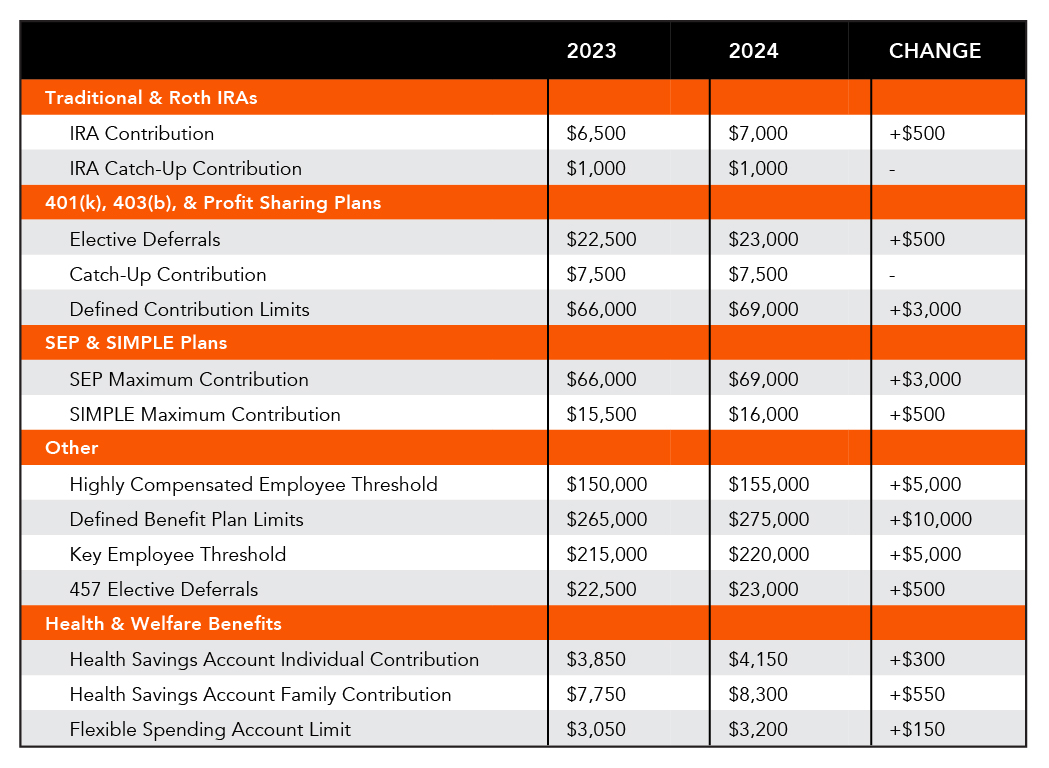

Plan Sponsor Update 2025 Retirement & Employee Benefit Plan Limits, If you earned less than $66,819 (if married filing jointly) or $59,899 (if filing as single, qualifying surviving spouse or head of household) in tax year 2025, you may qualify.

2025 Earned Limit Fran Malinde, Following are the conditions for claiming eitc on 2025 (filing april 2025) & 2025 (filing april 2025 )tax returns:

2025 Eic Limits Tamar Fernande, Check the irs website for income limits and other eligibility requirements based on your filing status and dependents.