Standard Deduction 2025 Turbotax

Standard Deduction 2025 Turbotax. Your standard deduction starts at $13,850. And for heads of households, the.

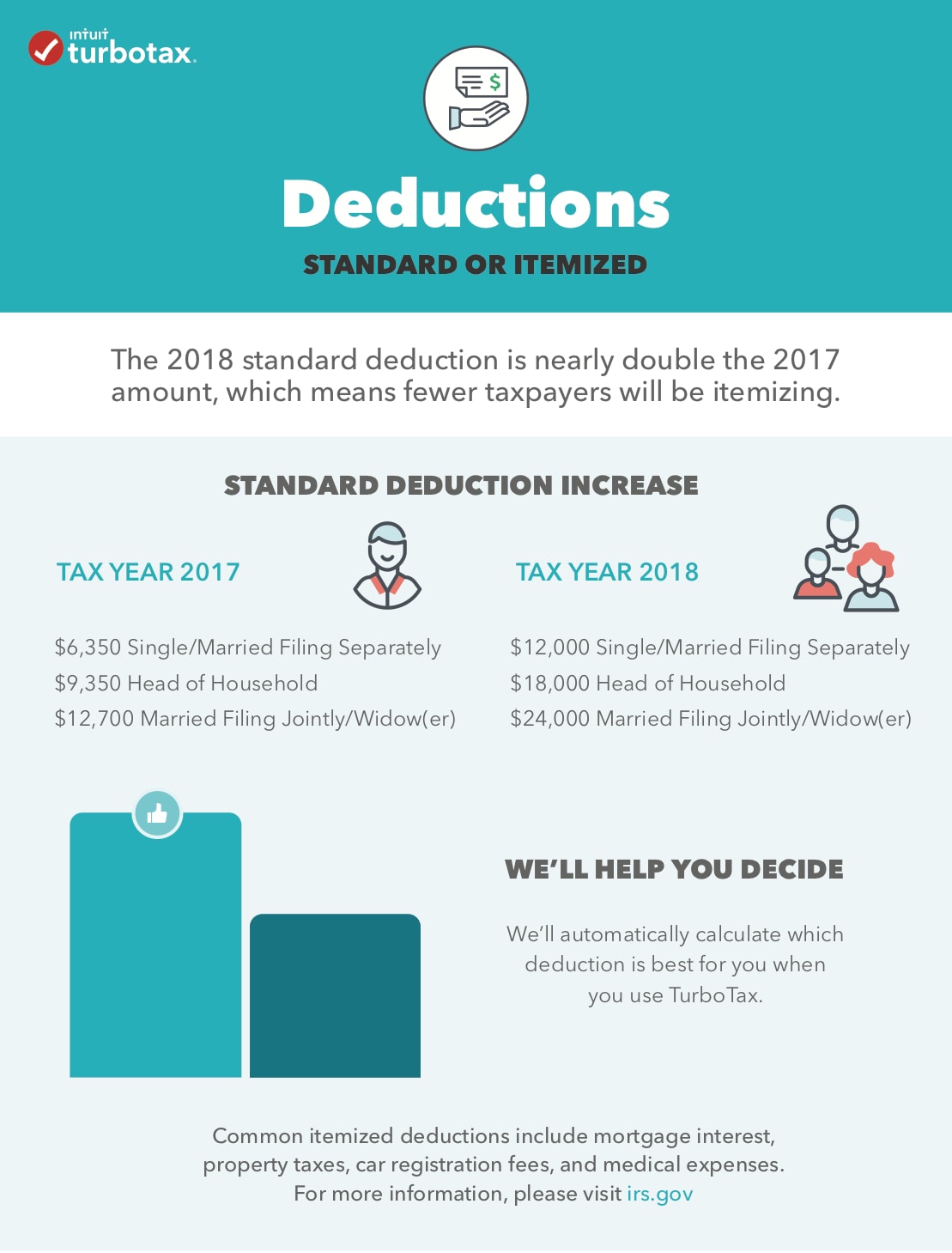

The standard deduction is a set amount based on how you file your taxes, with additional benefits for those who are 65 and older or visually impaired. (returns normally filed in 2025) standard deduction amounts increased between $750 and $1,500 from 2025.

I made under the standard deduction, and paid almost $200 in taxes yet turbo tax is claiming i did not qualify for any federal refund?

Standard Deduction For 2025 22 Standard Deduction 2025 www.vrogue.co, For 2025, assuming no changes, ellen’s standard deduction would be $16,550: What is the standard deduction?

![What Is the Standard Deduction? [2025 vs. 2025]](https://youngandtheinvested.com/wp-content/uploads/Standard-Deduction.jpg)

What Is the Standard Deduction? [2025 vs. 2025], Add $1,850 if you were blind as of december 31, 2025. Here are the standard deduction amounts for the 2025 tax returns that will be filed in 2025.

Standard deduction amounts for 2025 tax returns Don't Mess With Taxes, The usual 2025 standard deduction of $14,600 available to single filers, plus one additional standard deduction of. Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2025 •.

Standard Deduction College Aftermath, The standard deduction is a set amount based on how you file your taxes, with additional benefits for those who are 65 and older or visually impaired. (returns normally filed in 2025) standard deduction amounts increased between $750 and $1,500 from 2025.

Standard Deduction vs. Itemized Deductions Which Is…, Add $1,850 if you were blind as of december 31, 2025. Solved • by turbotax • 4326 • updated february 08, 2025 the federal standard deduction is a.

2025 Taxes for Retirees Explained Cardinal Guide, For single taxpayers and married individuals filing separately, the standard deduction rises to $14,600 for 2025, an increase of $750 from 2025; Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2025 •.

Can i claim my new car on my taxes TurboTax® Support, The 2025 standard deduction is $13,850 for single taxpayers. The standard deduction is adjusted for inflation every year, and for single taxpayers (and married individuals filing separately), the standard deduction increased.

The IRS Just Announced 2025 Tax Changes!, When you get to the deductions & credit s section of your tax return, we'll ask you questions to determine the deduction. If you filed your taxes jointly on the $80,000 you made, your tax rates would be:

Standard Deductions for 20232024 Taxes Single, Married, Over 65, Here are the standard deduction amounts for the 2025 tax returns that will be filed in 2025. How does the standard deduction differ from itemizing deductions?

Standard vs. Itemized Deduction Calculator Which Should You Take? Blog, For those married and filing jointly, the standard deduction rose to $27,700 in 2025, up from $25,900 in 2025. Get a comprehensive understanding on how much turbotax costs, variations in pricing, what to expect in 2025 and how it compares with other tax services.